It was another year amid the Covid-19 pandemic, with sporadic outbreaks of new cases in a handful of cities and most Chinese living an essentially Covid-free life. The year began with a chip crisis, culminated in the launch of China"s Martian rover and ended with a closed door to foreign investors hoping to invest in genetic diagnosis and treatment. There is always hope and resilience with a leveled playing ground for all students in China and a soft landing of the real estate sector.

1. January: Many Industries in China are Struggling with a Severe Global Chip Shortage, which May Last into 2023Chinese carmakers faced a critical shortage of chips as the year 2021 had a bumpy start amid the coronavirus pandemic. Shanghai Volkswagen, FAW-Volkswagen, Guangqi Honda and GAC Toyota admitted that they were plagued by the shortage of chips, which are used in a wide range of applications, including driver assistance systems and navigation control. The average car has 50 to 150 chips. China’s cellphone makers, LEDs and consumer electronics were also hit hard by the shortage caused by too much demand and too little supply. The chip supply in China was exacerbated by the U.S.-China trade war. The shortage is expected to last into 2023.

2. April: Alibaba is Rebuked After Months of Anti-trust Investigations, Marking the Beginning of the End of Unchecked Growth of the Internet IndustryOn April 10, Chinese regulators slapped a record 28 billion fine on e-commerce titan Albaba for abusing its market dominance since 2015, sending a clear message to China’s high-flying internet industry that regulatory tightening was in place after two decades of a laissez-faire approach. The fine amounted to about 4% of the company"s 2019 domestic revenue and was the largest penalty ever in China for anti-trust violations.

Alibaba was slapped a record fine for anti-trust violations.

In retrospect, the Alibaba business empire came under strict scrutiny after billionaire founder Jack Ma made a high-profile public criticism of the country"s banking regulatory policy in October 2020. In about one month, Alibaba’s fintech arm Ant Group’s US$37 billion Hong Kong IPO being scuttled by the regulators, followed by an anti-trust probe into Alibaba by the State Administration for Market Regulation in December 2020.

3. May 17: Zhurong, the Rover, Makes History as the Chinese Explore Outer SpaceZhurong, the rover from China, touched down on the red planet, making China the second country in the world, after the United States, to successfully land their rover on the surface of Mars. The six-wheeled Zhurong, which looks similar to Nasa"s Spirit and Opportunity vehicles, has a mission to do geological research.

The rover named after the Chinese god of fire roamed over the surface of the red planet.

Named after the Chinese god of fire, the solar-powered rover was part of China’s ambitious space discovery, which included the launching of a manned orbital station and the landing of a person on the moon. In 2019, the world’s second largest economy became the first to put a space probe on the little-explored far side of the moon, and in December came back with rocks to Earth for the first time since the 1970s.

4. July: Didi’s Roller-Coaster Ride From an IPO to a Delisting in Less Than Half a YearChina’s cyberspace regulator launched a cyber security investigation into ride-hailing giant Didi Global on July 2, just days after its US$4.4 billion initial public offering on the New York Stock Exchange. The regulator said the move was to protect national security and address data security-related loopholes. It also said that Didi was not allowed to register new users during its investigation

The probe marked another major step in the regulatory tightening of the Internet industry after a whopping fine imposed on Alibaba in April. Didi secured its dominant position in China’s online ride-hailing markets after a subsidy war with Alibaba-backed Kuaidi and Silicon Valley-based Uber"s China unit, both of which were merged into Didi as investors found burning money hopeless and demanded a return on their investments.

On July 10, China issued the draft version of a new law, which requires the operator with access to information of over 1 million users to apply to the cyberspace regulator for the approval of their overseas IPO. Hello Chuxing, audio-sharing platform Himalaya and social media Soul that had originally planned to float an IPO in the United States switched to HKEx. In December, Didi announced that it would delist from New York and prepare for a listing in Hong Kong.

5. June 18 China’s Drive for Economic Equality Changes Corporate Culture of Internet CompaniesChinese President Xi Jinping reiterated CPC’s original socialism ideal when visiting a museum on the party’s history. The central government’s push for “common prosperity” has led to a year of sweeping changes. The policy aims to reduce the gap between the rich and the poor and one of its unintended results is that Chinese companies shift their focus from the overseas back to Chinese markets.

Alibaba has pledged US$15.5 billion to help the disadvantaged and also set up a team led by the company’s CEO and dedicated to the mission. Another tech giant Tencent committed US$7.75 billion to poverty reduction in China.

6. July 17: Zhengzhou flooding, the extreme weather event in 2021, reflects the urgency to address climate changeIn July, a flood devastated Zhengzhou, the capital of Henan province in central China and nearby Xinxiang, killing 302 people and afflicting locals with an economic loss of 114.2 billion yuan (About US$16.3 billion). The catastrophy was triggered by a downpour in three consecutive days that unleashed the average precipitation of a whole year. However, poor decisions made by municipal officials, including a delay in shutting the subway, schools and businesses, exacerbated the situation. Over 500 passengers were trapped in the tunnel of the subway for over 3 hours, leading to 14 deaths and five injuries.

Almost at the same time, Germany was also hit hard by a flooding that claimed the lives of over 200. In the United Stats and Venezuela, hurricanes killed hundreds. The too frequent natural disasters not only raised questions about city infrastructure, emergency management and disaster preparation and relief, but also urged humanity to reduce carbon emissions in general.

7. Educational reformOn July 24, China banned education companies that teach school subjects from making profits, raising capital or floating shares on a stock market, in a sweeping overhaul of its $100 billion tutoring sector. And school syllabus-related tutoring offered on vacations and weekends was also prohibited. The State Council, China’s highest administrative authority, said the move was intended to reduce students’ burdens relating to “homework and after-school training.” The overhaul is widely seen as a way to level the playing ground for all students and boost the declining birth rates in China.

The shift in education policy has dealt a body blow to tutoring giants, including TAL Education, New Oriental Education and Gaotu Techedu, because a majority of their revenues came from school subject training. Many tutoring centers were shuttered and thousands of teachers were laid off. Education companies in China had been market darlings in recent years, luring billions of dollars from overseas investors like Temasek and SoftBank.

8. August 30 Online gaming time further reducedNo online video games are allowed for minors on school days but they can play from 8 pm to 9 pm only on Fridays, weekends and public holidays, according to new regulations published by the National Press and Publication Administration on August 30. The move was intended to curb growing “video game addiction” among Chinese youth. Online gaming companies, such as China’s internet giant Tencent, will be prohibited from offering services to anyone under 18 beyond those hours and they must ensure they have real name verification systems in place. Meanwhile, the permit for releasing a new video game has not been granted since then.

The new rule marked the further regulatory tightening of the gaming industry. In 2019, the publication regulator limited the time for minors to game to 90 minutes on school days and three hours on holidays.

Tencent, the world’s most profitable online game company by revenue, reaped 32% of its total revenues from the online video game business segment in 2020. Minors contributed 6% of its top line in 2020, according to its annual financial report.

9. December 10, Evergrande DefaultsAfter months of worries that a default on dollar bonds by cash-strapped Evergrande may trigger China’s “Lehman moment”, markets in China did not collapse when the private real estate giant finally did. On the contrary, the stock markets hit a five-month high. There was even a rally in U.S. dollar bonds issued by China’s lowest-rated issuers. In June, news broke that the developer failed to fulfill its domestic debt obligation.

The rally was partially due to a government meeting that signaled there would be credit easing for the real estate sector. Earlier in 2021, the government had curbed lending to private developers in order to force them to deleverage and reduce structural risks in the macro-economy. Home prices in September 2021 declined for the first time in six years, followed by a continued drop in October and November. However, experts say that the worst time for the sector was over as a hard landing was avoided.

10. On December 27: A narrow door for foreign investors to genetic diagnosis is shut againThe National Development and Reform Commission issued Decree 47 and Decree 48, explicitly barring foreign investors from the fields of human stem cells, genetic diagnosis and treatment and related applications. It marks a reversal from a regulation issued by the Shanghai Government in August 2019 that allowed the access of foreign capital to such fields for the first time. In China, the central government’s decrees overrule the municipal government’s regulations.

The new rule by NDRC sent a clear signal that the stem cell and genetics field will resume as a forbidden area to foreign investors. The Special Administration Measures Regarding Access to Markets by Foreign Capital issued by the regulator, known as the “Negative List”, also mentions that foreign investors are prohibited from opening or running a medical institution on their own and they must form a joint venture with Chinese investors in order to enter or remain in the healthcare industry.

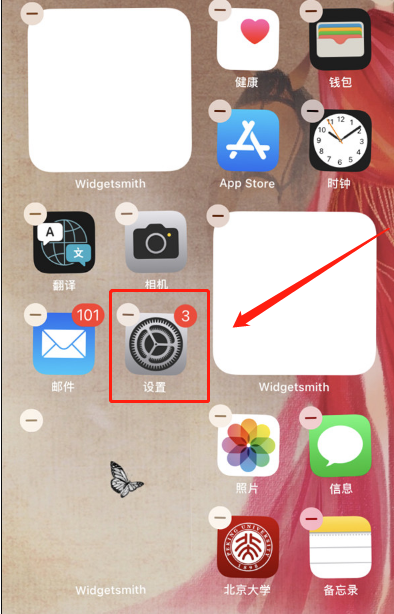

营业执照公示信息

营业执照公示信息